In today’s fast-paced digital world, businesses and individuals alike are seeking efficient and cost-effective ways to manage their finances. Two essential phrases that frequently surface in this context are “Online Accountant” and “Bookkeeping Services.” In this blog post, we’ll dive into the significance of these terms, explore the benefits they offer, and understand why they are crucial for financial success.

The Rise of the Online Accountant

In the age of the internet, traditional accounting practices have undergone a significant transformation. The concept of an “Online Accountant” is a testament to this evolution. Online accountants leverage technology to provide a wide range of financial services, making them accessible to businesses of all sizes and individuals looking to manage their finances effectively.

Key Advantages of Hiring an Online Accountant:

- Cost Efficiency: Online accountants typically offer competitive pricing structures. They eliminate the need for businesses to invest in physical office space and equipment, ultimately reducing overhead costs.

- Accessibility: With online accountants, geographic boundaries become irrelevant. Businesses can tap into the expertise of professionals from anywhere in the world, ensuring they receive top-notch financial services.

- Real-time Insights: Online accountants use cutting-edge software and tools that provide real-time financial data. This enables businesses to make informed decisions promptly, which is crucial in today’s dynamic business environment.

- Tailored Solutions: Online accountants often customize their services to meet the unique needs of their clients. Whether you require assistance with tax planning, financial reporting, or general bookkeeping, they can adapt their services accordingly.

The Importance of Bookkeeping Services

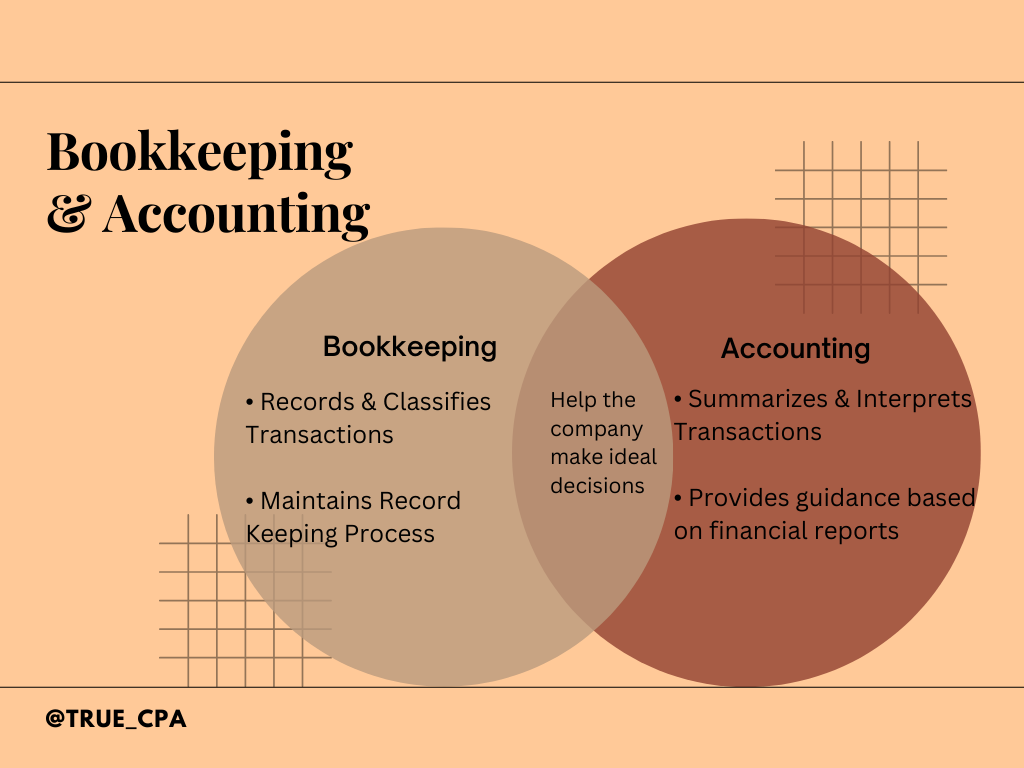

“Bookkeeping Services” are the foundation of sound financial management for both businesses and individuals. Bookkeepers play a pivotal role in maintaining accurate records of financial transactions, ensuring compliance with tax regulations, and facilitating decision-making processes.

Key Benefits of Professional Bookkeeping Services:

“Bookkeeping Services” are the foundation of sound financial management for both businesses and individuals. Bookkeepers play a pivotal role in maintaining accurate records of financial transactions, ensuring compliance with tax regulations, and facilitating decision-making processes.

- Accuracy and Compliance: Bookkeepers are well-versed in financial regulations and standards. They ensure that all financial records are accurate and up-to-date, minimizing the risk of errors and penalties.

- Time Savings: Outsourcing bookkeeping services allows businesses to focus on their core operations. This delegation of tasks not only saves time but also enhances productivity.

- Financial Analysis: Bookkeepers provide valuable insights into your financial health. They create reports and forecasts that help you identify areas for improvement and capitalize on financial opportunities.

- Tax Preparation: Bookkeepers are instrumental in preparing and organizing financial documents for tax purposes. This ensures that businesses remain compliant and can maximize their tax deductions.