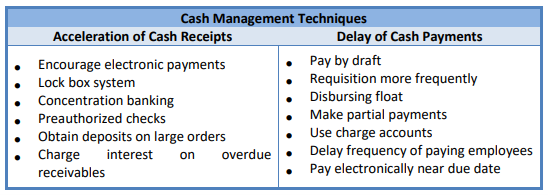

Acceleration of Cash Receipts

To improve cash management inflow, companies should evaluate the causes of, and take corrective action for, delays in depositing cash receipts. Analyze banking policies on fund availability and the time lag between check receipt and deposit. The types of delays in processing checks are:

• “Mail float”, the time required for a check to move from debtor to creditor

• “Processing float”, the time needed for the creditor to enter the payment

• “Deposit collection float”, the time it takes for a check to clear

Companies should consider all possible ways to accelerate cash receipts including the use of lockboxes, pre-authorized debits (PADs), wire transfers, and depository transfer checks.

LOCKBOX

A lockbox represents a way to place the optimum collection point near customers. Banks make collections from these boxes several times a day and deposit the funds to the corporate account. They then prepare a computer listing of payments received by account and a daily total, which is provided to the corporation. To determine the effectiveness of using a lockbox, a company should determine:

• The average face value of checks received

• The cost of operations eliminated

• The reduction in processing overhead

• The reduction in “mail float” days

Since per-item processing costs for lockboxes are typically significant, it makes the most sense to use one for low-volume, high-dollar collections. However, businesses with high-volume, low-dollar receipts are using them more as technological advances contribute to lowering their per-item cost.

WHOLESALE LOCKBOXES

These are used for checks received from other companies. As a rule, the average dollar cash receipts are large, and the number of cash receipts is small. Many wholesale lockboxes result in mail time reductions of no more than one business day and check-clearing time reductions of only a few tenths of a day. They are therefore most useful for companies that have gross revenues of at least several million dollars and receive large checks from distant customers.

PRE-AUTHORIZED DEBITS

Cash from customers collected faster when companies obtain permission to have pre-authorized debits (PADs) automatically charged to customers’ bank accounts for repetitive charges. This is a common practice among insurance companies that collect monthly premium payments via PADs. These debits may take the form of paper pre-authorized checks (PACs) or paperless automatic clearing house entries. PADs are cost-effective because they help avoid the process of billing customers, receiving and processing payments, as well as depositing checks. Using PADs for variable payments is less efficient because the amount of the PAD must be modified each period and the customer generally must be advised by mail of its amount. PADs are most effective when used for consistent, relatively nominal periodic payments.

WIRE TRANSFERS

To boost the business’s cash management, transfer funds between banks using wire transfers via computer terminals and telephones. Reserve wire transfers for significant amounts due to fees from both originating and receiving banks. Wire transfers work best for intra-organization transfers, such as moving funds to and from investments, making deposits on the day checks clear, and ensuring immediate funds in critical accounts. They’re also useful for funding other checking accounts, like payroll accounts. Ensure all bank accounts maintain adequate balances to avoid overdrafts.

DEPOSITORY TRANSFER CHECKS (DTCs)

Paper or paperless depository checks used to transfer funds between the company’s bank accounts. They do not require a signature since the check is payable to the bank for credit to the company’s account. DTCs typically clear in one day. It is usually best to use the bank’s printer since it is not cost-effective for the company to purchase a printer. Automatic check preparation is advisable only for companies that must prepare a large number of transfer checks daily.

There are other ways to accelerate cash management inflow, including:

• Sending bills to customers sooner than is the company’s practice, perhaps immediately after the order is shipped.

• Delivering invoices electronically rather than via mail to speed up billing and collection.

• Requiring deposits on large or custom orders or submitting progress billings as the work on the order progresses.

• Charging interest on accounts receivable that are past due and offering cash discounts for early payment; use cash-on-delivery terms

• Implementing effective accounts receivable practices such as reducing error rates on invoices, adopting a regular schedule to follow up on collections, negotiating favorable terms and rebates with suppliers, issuing purchase orders for new orders, and periodically benchmarking vendor contracts against industry standards.

Checklist of Ways to Accelerate Receipts for Cash Management

• Lockbox: Payments are picked up several times during the day by the bank

• Concentration banking: Funds are collected in local banks and then transferred to a main concentration account

• Immediate transfer of funds between banks: Transfers would be accomplished through depository transfer checks or via wire

• Cash discounts for early payment

• Accelerated billing practices

• Personal collection efforts

• Cash-on-delivery

• Depositing checks promptly

• Obtaining cash tied up unnecessarily in other accounts (for example, loans to company officers)

Controller’s Handbook: A Road to Success (www.mastercpe.com)