Introduction

In the construction industry, projects can span months or even years. In this case, accurately reporting financial progress is important.

The percentage of completion method is an accounting method. It increases accuracy and reliability. In addition, it not only reflects the true financial status of ongoing projects but also significantly smoothens the bonding process. This method provides bonding companies with a clear picture of a company’s financial health and project progress.

The Essence of the Percentage of Completion Method

This accounting method allows companies to recognize revenue and expenses. This adjusts in proportion to the actual work completed on a project.

Unlike the completed-contract method, which only recognizes revenue and expenses at the project’s end. The percentage of completion method offers a real-time financial snapshot. It aligns revenue recognition with the project’s progress.

Implementing the Percentage of Completion Method

- Project Cost Tracking: Start by tracking all project-related costs, like materials, labor, and overhead. This step makes sure the revenue recognized matches the actual expenses.

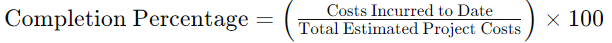

- Calculating Completion Percentage: Regularly check the project’s completion percentage by comparing the costs so far with the total estimated costs.

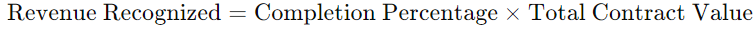

- Revenue Recognition: Use the completion percentage to recognize revenue in proportion to the total contract value. This makes sure the financial statements show the project’s true progress and profitability.

- Regular Reassessment: Projects often change, affecting their scope, costs, and timelines. Regularly update estimates and adjust the completion percentage. This keeps financial records accurate.

Calculating the Percentage of Completion Method

To calculate the percentage of completion method for long-term projects, follow these key steps to accurately recognize revenue and expenses. Here’s a detailed breakdown:

Benefits Beyond Bonding with a CPA

While the primary focus here is on smoothing the bonding process, the percentage of completion method offers additional benefits:

- Improved Cash Flow Management: By accurately recognizing revenue throughout a project, companies can manage their cash flow better. This helps them make smart decisions based on current financial data, ensuring they can pay their bills and invest in new opportunities.

- Enhanced Decision-Making: Real-time financial insights help companies make better project decisions, like adjusting project scopes or allocating resources. These insights lead to more efficient project execution, reducing delays and costs.

- Investor and Stakeholder Confidence: ransparent and accurate financial reporting builds trust among investors, stakeholders, and financial institutions. This trust results in more favorable financing terms and investment opportunities, showing stakeholders that the company is financially stable and capable of managing projects well.

CPA Case Study: XYZ Construction’s Success Story

XYZ Construction, a mid-sized firm that builds commercial buildings, switched to the percentage of completion method two years ago. This change was part of a plan to improve their bonding capacity and financial management. The results were amazing:

- Bonding Capacity: XYZ’s bonding capacity increased by 30%, allowing them to bid on bigger projects.

- Financial Stability: More accurate revenue recognition improved cash flow management, reducing financial stress during long-term projects.

- Stakeholder Confidence: Clear and reliable financial reports strengthened relationships with investors and financial institutions, leading to better financing options.

Conclusion

Using the percentage of completion method is more than just an accounting change. It is a smart business decision that can help a construction company grow. By giving an accurate financial picture, it helps build a strong foundation for long-term success. For construction companies wanting to improve their market position, adopting this method is a good move.