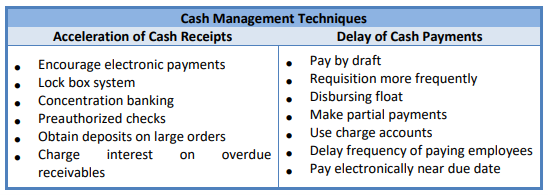

Delay of Cash Outlay

For cash management, delaying cash payments can help a company earn a greater return and have more cash available. Companies should evaluate their payees and determine to what extent they can reasonably stretch payment deadlines without incurring finance charges or impairing their credit ratings. There are many ways to delay cash payments, including centralizing payables, having zero balance accounts, and paying by draft.

CENTRALIZE PAYABLES

Companies should centralize their accounts payable operations – that is, make one center responsible for all payments so that debt may be paid at the most profitable time and the amount of disbursement float in the system may be better determined.

ZERO BALANCE ACCOUNT (ZBA)

Cash payments may be delayed by maintaining zero balance accounts in one bank for all of the company’s disbursing units. In this case, funds would be transferred in from a master account as needed. The advantages of ZBAs are that they allow for better control over cash payments as well as reduced excess cash balances in regional banks. Using ZBAs is an aggressive strategy that requires the company to put funds into its payroll and payables checking accounts only when it expects checks to clear. However, companies must also watch out for overdrafts and service charges.

DRAFTS

Payment drafts are another strategy to delay disbursements. With a draft, payment is made when the draft is presented for collection to the bank, which in turn goes to the issuer for acceptance. When the draft is approved, the company deposits the funds into the payee’s account. This delay allows the company to maintain a lower checking account balance. Banks usually impose a charge for drafts. Drafts can provide a measure of protection against fraud and theft because they must be presented for inspection before payment.

DELAY IN MAIL

We can delay cash payment by drawing checks on remote banks. Therefore, it ensuring that checks take longer to clear. If mail float is utilized properly, the company can maintain higher actual bank balances than book balances. For instance, if a company writes checks averaging $200,000 per day and they take three days to clear, they will have $600,000 ($200,000 x 3) in the checking account for those three days, even though the money has been deducted in the records.

CHECK CLEARING

Companies can use probability analysis to determine the expected date that checks will clear. Probability is defined as the degree of likelihood that something will happen and is expressed as a percentage from 0 to 100. For example, it is likely that not all payroll checks are cashed on the payroll date. Therefore, a company can deposit some funds later and earn a return until the last minute. The probability and costs of overdrafts also needs to be considered.

DELAY PAYMENTS

Companies can reduce the frequency of payments to employees; for example, they could institute a monthly payroll rather than a weekly one. In this way, the company can use this cash for a longer time period. Companies could also disburse commissions on sales when the receivables are collected rather than when sales are made. Finally, companies could utilize noncash compensation and remuneration methods (e.g., distribute stock instead of bonuses).

Other ways to delay cash payments:

• Instead of making full payment on an invoice, make partial payments.

• Use a charge account to lengthen the time between buying goods and paying for them.

Checklist of Ways to Delay Cash Payments

• Centralize accounts payable operations. This enables companies to meet their obligations at the most financially efficient time. It also enhances the company’s ability to predict their disbursement float in the system.

• Use drafts. A draft is given to the bank for collection, which in turn goes to the issuer for acceptance. After this, these funds are deposited to pay the draft.

• Use electronic payments to transfer funds between various bank accounts at opportune times.

• Draw checks on remote banks. For instance, a New York company could use a California bank to draw its checks.

• Mail checks from post offices with limited services or where mail must go through several handling points.

• Use probability analysis to determine when checks are expected to clear. For example, funds deposited on payday may not need to be equal to the entire payroll amount since not all checks will be cashed on that day.

• Use credit cards/charge accounts for purchases rather than cash.

• Make partial payments.

Controller’s Handbook: A Road to Success (www.mastercpe.com)